Mid-to-Large Balance Loan Program

When it comes to purchasing or refinancing your own building or an eligible income producing property our mid-to-large balance loan program is considered one of the most desirable ways to achieve your goal of obtaining the combination of leverage with incredibly competitive rates.

Our to-large balance loan program is designed to help businesses owners and investors refinance debt, purchase or improve an existing commercial building, complete a 1031 exchange, perform leveraged partner buy-outs and numerous other purposes.

Advantages of our Mid-to-Large Balance Loan Program:

- Non-recourse financing with standard industry carve-outs

- NO BANKING RELATIONSHIP REQUIRED. Borrowers are free to keep their operating accounts where ever they desire.

- Balloon or fully amortizing loans programs up to 30 years.

- Closing costs such as appraisal fee, environmental fees, contingency fees can be included in the financing so long as LTV limits are not exceeded.

- Nationwide loan program

- Flexible prepayment penalty options from a declining 5-4-3-2-1, yield maintenance and/or defeasance prepayment penalty

- Origination fee up to to 1.00%

Structuring Of our Mid-to-Large Balance Loan

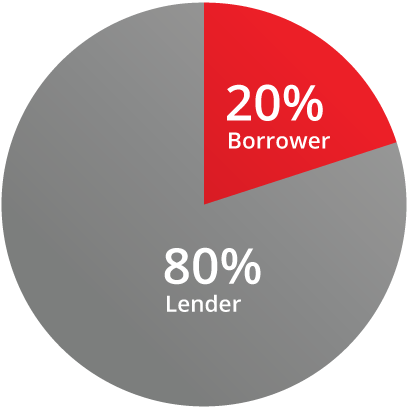

The Mid-to-Large Balance Loan Program has two participants (see chart below):

- Loan Amounts from $ 2,000,000 up to $ 50,000,000

- A 1st Mortgage loan for up to 80% of the property value Arrow Mortgage, LLC offers one the widest variety of first mortgage programs in the industry. We offer a 3yr fixed rate, 5yr fixed rate, 7yr fixed rate, 10yr fixed rate. These loans are amortized up to 30 years. We also offer a 15yr-30yr fully amortizing fixed rates.

- A Borrower/Investor is required to contribute a down payment of at least 20% of the total project cost or retain 20% equity in the property for refinances.

To Meet the Minimum Qualification For a Loan The Business/Entity Must:

- Be organized as a for-profit business. Unfortunately, the loan program is not designed for non-profit businesses

- Be organized as a sole proprietorship, corporation, partnership or limited-liability corporation (LLC)

- Possess a minimum historical cash flow of at least 1.25X for Single Tenant Properties, 1.35X for Owner-User Properties and 1.15X for Credit Tenant Income Properties

- Maximum LTV of at 75% for Single Tenanted Properties, maximum of 80% LTV for Owner-User properties and in rare cases up to a maximum of 85% LTV for credit Tenant Income Properties.

- We will consider the top 200 markets nationwide and suburban/suburban area with a population of at least 100,000 within 5 miles of subject property.

Other Eligibility Requirements

- Ineligible properties are: Gas Stations, Car Washes, Auto Dealerships, Night Clubs, Fitness Centers, Athletic Clubs, Churches and any environmentally sensitive properties.

Interested in applying?

Please complete the enclosed form and a Representative from Arrow Mortgage, LLC will promptly contact you.

Free Initial Assessment

Contact us today to obtain a free initial assessment of your current financial situation

Email: info@commercialfunds.com

Phone: (321) 400-9060

Interested in applying?

Please complete the enclosed form and a Representative from Arrow Mortgage, LLC will promptly contact you.

Arrow Mortgage, LLC may be able to provide you with conventional real estate secured financing for your next project up to $8,000,000

If you are an established business owner and you are looking to purchase a property with a minimum down payment Arrow Mortgage, LLC may be able to provide you with up to 90% LTV with SBA 504 financing for your next project up to $ 13,000,000.

If you are a business owner and you are looking to refinance debt or purchase a property with a minimum equity injection Arrow Mortgage, LLC may be able to provide you with up to 90% LTV with SBA7(a) financing for your next project up to $ 5,000,000.

Arrow Mortgage, LLC may be able to provide you with real estate secured financing for your next project up to $50,000,000